Melio Payments —Supercharge Your Business with Shopify Bill Pay (July 2025)

Although it is thrilling to start an e-commerce shop, controlling money matters might prove difficult for fresh entrepreneurs.

Shopify, which is a top e-commerce platform, provides a three-day shopify free trial period that does not require one to use a credit card. After that, there is also an extended package over 3 months available at $1 per month for some select plans.

With this offer, you have the chance to experience the full potential of Shopify without having to invest too much money.

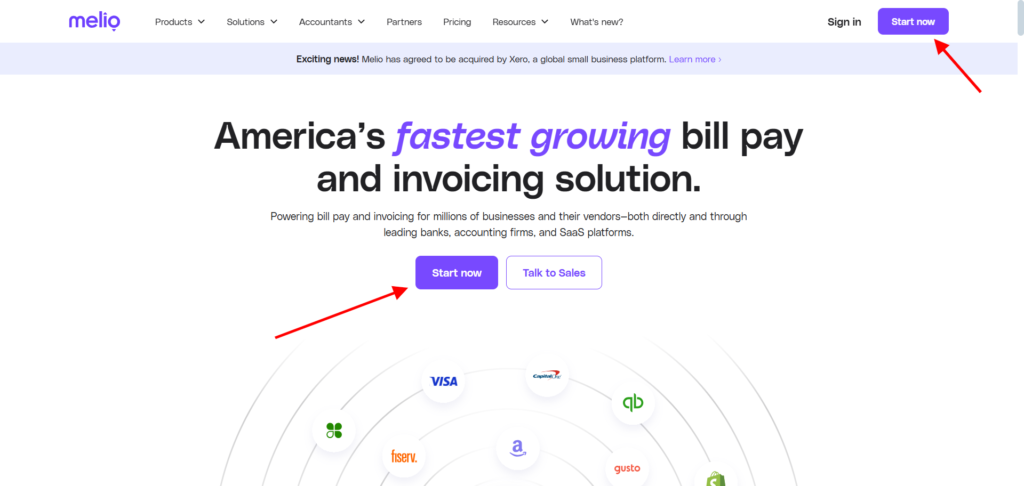

One such tool that will be extremely useful when you have this is Shopify Bill Pay; and it runs on Melio Payments enabling users to manage as well as pay off business bills right at their Shopify admin dashboard.

This manual will explain how you can employ Melio Payments via Shopify Bill Pay in streamlining of business finances and progression focus during the period when such services are still free.

» Shopify free trial | Get now

Understanding Shopify Free Trial

New sellers can take full advantage of the free trial provided by Shopify in evaluating the strength of the system at no cost. You can follow these steps to begin:

1. Sign up for the shopify free trial

Go to Shopify Free Trial Offer and type your email address there to get started. For the first three days, you don’t have to use any credit cards.

2. Set up your store

Skip them and start exploring the Shopify admin interface or answer a few optional questions about your business first. It will be possible to customize your store, put up products for sale and check out other functions available with ease for now.

3. Prolong your trial

After the 3-day period is over, extend your three months $1/month access under some plans (except Shopify Plus) by following these steps: click here and enter your payment details (card or PayPal) to activate this offer.

4. Explore apps

While on shopify free trial, your store will have either a storefront password or inactive checkout but you could also install/test such apps as Shopify Bill Pay for better performance.

This trial is just right for creating your store and trying out Shopify Bill pay which is meant to help in controlling buyer’s money before it gets into wrong hands like impulsive buyers also known as jokers.

Who will never leave your store without buying anything due to ego issues which need to be addressed extensively but we shall leave that explanation for another day when we meet at the store itself so come on over already because there’s no time like now!

What is Shopify Bill Pay Powered by Melio Payments?

The year 2023 saw the introduction of an effective business payments solution known as Shopify Bill Pay which was closely integrated with Melio Payments.

It eases the accounts payable of merchants since they can pay off the invoices and keep track of them on the same platform. Some of the things that are found in this feature are described below:

— Flexible payment methods

Users can pay bills suing Shopify balance, credit or debit cards, ACH bank transfers for domestic payments, international payments may be paid using bank accounts/ or Shopify Balance at USD.

— Vendor payment options

Vendors will be able to receive their payments through wire transfer or paper check for international ones), even when they refuse your chosen mode of payment.

— Global reach

With Melio, payments can be done in more than one hundred countries; therefore it is good for those who buy from abroad.

— Accounting integration

Integrate these payments with your accounting software like QuickBooks Online or Xero and smoothen the bookkeeping process.

— No subscription fees

You can get Shopify Bill Pay without having to pay any monthly fee. However there will be charges on transactions for some types of payments like when you use credit card and the rate may be around 2. 9%.

Benefits of Using Shopify Bill Pay

— Time efficiency

According to Shopify, their merchants are able to spare 16 hours monthly for settling bills since their platform is two times faster than other B2B expense managing platforms.

— Cost saving

The absence of installation charges and subscription charges make it affordable for start-up companies. Also, there are no extra costs for ACH bank transfers or Shopify Balance payments.

— Cash flow management

Plan your expenses in such a way that you would be able to keep your money liquidity even throughout the probation phase before joining employment with care Credit.

— Simplified vendor management

Easily include vendors and allow them to select how they want to be paid so that you can reduce administrative stress.

Setting Up Shopify Bill Pay During Your Free Trial

During your free trial with Shopify, you have an option of putting into place and trying out Shopify Bill Pay. Take the following steps to begin:

1. Install Shopify Bill Pay

— Access your Shopify admin dashboard.

— Using the available “Shopify Bill Pay” tool in the Shopify App Store, install it on your site.

— There is no cost for subscribing; therefore, click “Install” to add the app to your account.

2. Add Vendors and Bills

— Go under the Shopify admin area and open the Bill pay tab.

— Follow these two options for adding vendors; i. e., either input them yourself or give out unique email addresses through which bills can be automatically populated within the list of unpaid ones.

— For easy entry of bills, upload or forward invoices

3. Make Payments

— On the Shopify Bill Pay dashboard, pick any unpaid bill.

— When using Shopify Balance, credit/debit card, or ACH bank transfer as your payment options in what way should you pay attention that the vendor receives money (bank transfer, paper check for domestic; wire transfer for international).

— Choose either to pay instantly or schedule it. The system will deliver the payment and make sure that vendors are paid on time as expected through Shopify Bill Pay.

4. Integrate with Accounting Software

— You can link Shopify Bill Pay with QuickBooks Online or Xero so that it automatically updates new vendors and any incoming bills or payments.

However, during this period of trying out your service and products you may need this kind of integration since there will be much more work otherwise on a daily basis – like entering data about expenses all day long!

Maximizing Shopify Bill Pay During the Free Trial

If you decide to use Shopify Bill Pay while on trial, you can be able to set up some very effective ways of dealing with your initial finances. The following are some ways that will assist you in doing this:

— Test payment workflows

Try out different payment methods like using credit cards so that you can earn some discount and also using ACH transfers which may be free.

— Manage cash flow

Make payments as scheduled depending on when your budget allows for it so that you keep a close eye on your financials throughout the experimentation phase.

— Track expenses

Take advantage of the sorting, filtering options offered by Shopify Bill Pay dashboard on upcoming expenses; this will make visible all financial commitments.

— Prepare for scaling

The introduction of Shopify Bill Pay at an early stage will develop into one smooth evolving payment channel on upgrading to paid Shopify plan as business grows.

Tips for Success

— Start with key vendors

Integrate some important vendors for initial testing of Shopify Bill Pay without complicating everything with too many payees during this short period.

— Use free payment options

Go for either ACH bank transfers or Shopify Balance to cut on transaction charges that may accrue during the test period.

— Monitor payment status

Keep track of your payments in the Shopify Bill Pay dashboard to make sure that they are done on time and avoid any extra charges.

— Leverage accounting sync

Integrate with QuickBooks or Xero from the beginning to make accounting work easier and leave the rest part in setting up shop.

Why Melio Payments Enhances the Shopify Experience

According to the CEO of Melio Payments, Matan Bar, the partnership eases paying of bills in Shopify Bill Pay by adding some important tools in it which may be very beneficial for new traders.

With this integration, users will be able to work with Shopify Balance seamlessly while at the same time being allowed to effect payments to various suppliers globally since their services span across 100 different countries.

It is possible to verify that you will operate a proper financial system once your online store is live without having to pay for these services immediately through the use of the free trial offer.

Conclusion

Simplify your bill payments with Melio Payments’ integration into Shopify and an opportunity to optimize your financial transactions right from when you begin using Shopify.

One way of making sure that you follow this advice is by setting up Shopify Bill Pay within the first 3-day free trial or the additional extended 3-months whereby it cost $1 per every month.

This will help you in saving money as well as ensuring that cash flows as they should and also enable you put more effort on creating the best e-commerce store for yourself.

The fact that there are no extra costs for subscriptions and that the tool provides multiple payment options makes it perfect for any new vendors who want to test out what Shopify can do.

So where’s your part? Just go to “Shopify Free Trial Offer,” get your own at zero cost, and see the difference aligning with Melio payments.

Shopify Bill Pay Features and Benefits

| Feature | Description | Benefit |

| Multiple Payment Methods | Pay via Shopify Balance, credit/debit card, or ACH bank transfer. | Flexibility to choose cost-effective or rewarding payment methods. |

| Vendor Payment Options | Vendors receive payments via bank transfer or paper check, regardless of your method. | Simplifies payments for vendors who don’t accept cards. |

| International Payments | Pay vendors in over 100 countries in USD via wire transfer. | Supports global business operations. |

| No Subscription Fees | Free to install and use, with transaction fees only for certain methods. | Cost-effective for new businesses during the trial period. |

| Accounting Software Sync | Integrates with QuickBooks and Xero for automatic syncing of bills and payments. | Reduces manual bookkeeping and saves time. |

| Time Savings | Saves an average of 16 hours per month on bill payments. | Allows merchants to focus on growing their business. |

Shopify Free Trial Details

| Trial Aspect | Details |

| Duration | 3 days free, no credit card required; extendable to 3 months for $1/month. |

| Access to Apps | Full access to Shopify App Store, including Shopify Bill Pay. |

| Limitations | Storefront password or inactive checkout during trial; no live sales. |

| Post-Trial Options | Choose a paid plan or continue for $1/month for 3 months on select plans. |

for more,

Shopify for Doctors — Success Stories & How to Start (July 2025)

Shopify Rise 2025 (Top Stats, GMV, and CMS Growth)

Shopify 3 Month Free Trial 2025 — Steps to Signing Up, Using, and Canceling

- Shopify Plus Trial [Jan 2026]— Shopifying Success, Simply Explained - October 2, 2025

- Shopify 1MBb Free Trial [Jan 2026]— Shopifying Success, Simply Explained - September 26, 2025

- Shopify 120 Days Free Trial [Jan 2026]— Shopifying Success, Simply Explained - September 25, 2025

One Comment