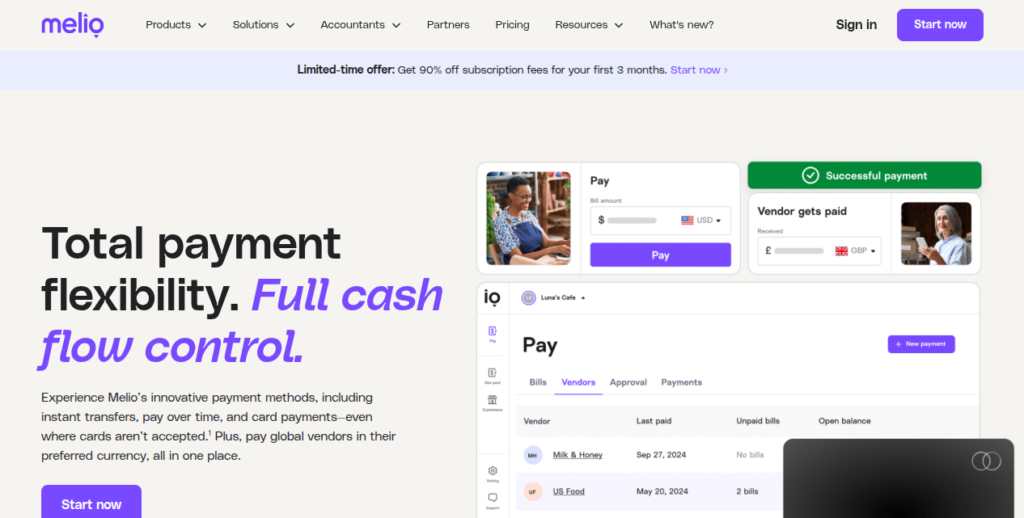

Melio FREE TRIAL 2025 — Is It Right for Your Business?

It is always an amazing experience to run your own business. However, one may find it hard to keep track of the bills. Melio is the platform which eases bill payment process for business. You can test the features by using a melio free trial available through the platform. The following is an analysis of the Melio free trial for Melio, put in plain words so that it is understandable.

— — — What does Melio provide and how does its complementary phase operate? — — —

What is Melio?

Melio is a small business-friendly online payment platform that facilitates payment of vendors and bills. With Melio, payments can be made using three alternatives; bank transfer, credit card, or check. This platform was created to make payments easier and save time too. It has an intuitive design that even novices will be comfortable using.

What is the Melio Free Trial?

New users can take advantage of Melio’s costless experimentation phase to evaluate the platform before committing financially. With the Melio free trial, one is able to use almost everything provided, make transactions, check how well it works. Even though there is no stated time within which one should finish using the product for free, Melio might deny particular options until you pay. By testing whether Melio fits into your trade, the melio free trial serves its purpose well.

How to Sign Up for the Melio Free Trial

It’s simple to register. Go to the Melio site. Select the “Sign Up” button. Just type in your email, business name and password. You don’t have to give out any credit card details. Therefore, you are able to try it with no risks at all. As soon as you have registered, you will be provided with immediate entry to it. It will only take about five minutes. The interface of Melio will lead you on what to do every step of the way.

Features You Can Test in the Free Trial

During the melio free trial, you will be able to sample a variety of functions. Some main ones are as follows:

1. Bill Management

By using Melio, you can input invoices. They will be arranged for you in the platform. It is simple to know what has been paid and what is outstanding. One can either manually upload the bills or sync with accounting software and it easily works in Melio; therefore, this feature spares busy business owners some moments.

2. Payment Options

There are different ways through which you can make payments using Melio. Firstly, you can use the ACH bank transfer option and pay your vendors at zero cost. Credit card payments are also possible, but they attract a low charge of under 2. 9%. Vendors may get their money through cheques or direct deposits. All these alternatives can be put to test during the trial phase. It helps one determine the most appropriate way.

3. Vendor Management

With Melio, keeping records of your suppliers’ information is possible. Addition of details concerning their banking or mailing address is allowed. This ensures that future payments will be quick. Setting up numerous vendors is also allowed under the trial package; therefore, it is useful for many supplier-based enterprises.

4. Approval Workflows

One can create payment approval processes. For instance, someone from the team should see and approve the payment before it goes out. This function is important in organizations where there are many employees. The melio free trial has included this feature as well. It enables you to carry out an analysis on how effective Melio is within your group’s activities or operations.

5. Syncing with Accounting Software

It links up well with various accounting packages such as QuickBooks and Xero among others. You just have to synchronize bills as well as receipts or payments done through any of these means of exchange in order to achieve this objective of maintaining up-to-date records. Such an integration is evaluated during the test phase of the trial. Bookkeeping would take too much time without this important feature.

User Experience: Is Melio Easy to Use?

The interface of Melio is plain and straightforward. It has an easily navigable dashboard. All bills and payments can be seen at a glance. The buttons have clear labels on them. Also, instructions provided are simple. Anyone, even those who are not very good with technology, can learn fast enough. During this free trial period, you have enough time to explore without any hurry. If you encounter any problem, Melio provides customer support through email or chat.

I personally took advantage of the melio free trial. Creating the account was fast and easy. It took me less than one minute to upload the bill. Every step was explained by the platform as I proceeded with it. Paying the vendor was also a simple process. I made attempts on using both bank transfer and credit card payment methods. They both went through without any complications. Only issue concerned credit card fee, although it is clearly stated and therefore there were no surprises whatsoever.

Benefits of the Free Trial

The Melio free trial has many advantages. First, it’s risk-free because there is no need to input financial information. Second, you are able to try out everything as it is very adaptable. Thirdly, this is a time saver since with Melio in place one will know whether or not to go about it fast. Finally, this is very useful especially for small scale traders. Through the experiment, you can conclude whether Melio is costly or valuable.

Limitations of the Free Trial

The melio free trial is not without restrictions. Some details on what cannot be shared by Melio are left undisclosed. You might be limited to a certain number of payments, e. g., fifty. You may not access completely some enhanced functions such as international payments. Be that as it may, credit card charges are applicable even on the trial. A paid package is necessary for full access. Premium features in Melio cost as from $20 monthly.

Tips for Making the Most of the Free Trial

Do the following to maximize your trial:

1. Use all the functions for evaluation: Experiment with uploading of bills, payments, integrations etc to have an understanding of what Melio can do.

2. Let Your Staff Participate: Ensure that you involve them in trying out the approval processes to see if it really suits all.

3. Get in Touch with the Support Team: In case of any inquiries, just approach the Melio team. You will get timely and useful responses.

4. Monitor Time Saved: Remember to record how much time you save with Melio relative to your normal activities. It will make it easier to explain why the investment was necessary.

5. Evaluate Vendor Feedback: Question a seller about their mode of receiving funds through Melio. They will provide very important information.

Who Should Try the Free Trial?

The Melio free trial is perfect for SME owners, freelancers as well as starting entrepreneurs. This is the right solution for people who take long doing payments every month because it provides an easy way of carrying online secure transaction, with quickBooks or Xero users must definitely try out this package while it may not be suitable for companies requiring extensive cross-border payment systems.

How Does Melio Compare to Others?

Melio is a cheaper and easier alternative to Bill. com and PayPal. Unlike Bill. com, PayPal does not have much ability to manage bills but it is great for transactions that are fast. Melio has an advantage because of its free trial. With Melio, you don’t pay before trying like other platforms.

My Experience with the Trial

The trial was easy for me to use. I could easily understand the dashboard. I attached a sample invoice and transferred money to one of my suppliers promptly. It was very easy syncing with QuickBooks. However, there was only one problem – the charge for using credit card that piled up on high payments. Generally speaking, this test made me feel assured about Melio’s characteristics. Indeed this is a reliable instrument for entrepreneurs.

How Does Melio Compare to Others?

Melio competes with platforms like Bill.com and PayPal. Below is a comparison table to show how they differ:

| Feature | Melio | Bill.com | PayPal |

|---|---|---|---|

| Free Trial Available | Yes | No | No |

| Bill Management | Yes | Yes | Limited |

| Payment Options | Bank Transfer, Credit Card, Check | Bank Transfer, Credit Card | Credit Card, PayPal Balance |

| Credit Card Fee | Up to 2.9% | Up to 2.9% | 2.9% + $0.30 per transaction |

| Accounting Software Sync | QuickBooks, Xero | QuickBooks, Xero, Others | Limited |

| Vendor Management | Yes | Yes | No |

| Approval Workflows | Yes | Yes | No |

| Best For | Small Businesses, Freelancers | Medium to Large Businesses | Quick Transactions |

| Ease of Use | Very Easy | Moderate | Easy |

Conclusion

Melio free trial period is an excellent opportunity for trying out a very effective payment system. This application is simple and contains many options for use. With this you will be able to handle invoices, make payments to suppliers and synchronize with accounting tools. The trial is safe and can adapt to different situations. This will be of great help among small-scale traders. Although it has certain restrictions, it allows you to determine whether Melio suits your needs. Join now to experience its effect on your money transfers!

fore more,

Melio Payments —Supercharge Your Business with Shopify Bill Pay (2025)

- 🛍️ What Is Shopifying? - October 14, 2025

- Tired of TECH Headaches? Try Shopify DISCOUNT COUPON (Jan 2026) - August 3, 2025

- Shopify 6 MONTH TRIAL— Why This Amazing DEAL Has Me Yelling! - July 31, 2025